Here is a great article I read about Employment and Self Employment Taxes. It is from SmartMoney taken from Yahoo Finance, written by Bill Bischoff. You have been hearing a lot about raising taxes and tax breaks. That all has to do with Income Tax. These are the other (not so) little taxes that everyone pays. As it stands right now, the money will run out, so one of two things needs to happen. We need to pay in more, or there needs to be less paid out. Over the next 20 years, I bet you can expect both of these things to happen, as well as the age ceiling raised for when you get your payouts.

-David Bixel

SmartMoney

While you hear a lot about the federal income tax, you don't hear much about the Social Security tax. That's odd because for many folks especially the self-employed Social Security tax can be the bigger hit. Here are some little-known truths about how the Social Security tax works and how much it can amount to.

As an employee, your wages are hit with the 12.4% Social Security tax up to the annual wage ceiling. Half the Social Security tax bill (equal to 6.2%) is withheld from your paychecks. The other half is paid by your employer. Unless you understand how the tax works and closely examine your pay stubs, you may be blissfully unaware of how much the Social Security tax actually costs.

The Social Security tax wage ceiling for both 2010 and 2011 is $106,800. If you made that much or more last year, the Social Security tax hit on your 2010 wages was a whopping $13,243 (12.4% x $106,800). Half came out of your paycheck. Your employer paid the other half.

For 2011, the tax hit is less, thanks to a one-year 2 percentage-point reduction in the Social Security tax withholding rate on wages -- from the normal 6.2% to 4.2% (your employer's 6.2% rate is unchanged). For 2012 and beyond, however, Social Security tax withholding on your wages will jump back to the standard 6.2% rate.

While many employees may not realize the magnitude of the Social Security tax, self-employed folks know it all too well. That's because the self-employed must pay the entire 12.4% tax rate out of their own pockets, based on the amount of their net self-employment income. This is one big reason why companies often prefer to treat workers as self-employed independent contractors rather than employees. Companies don't owe any Social Security tax on amounts paid to independent contractors.

For both 2010 and 2011, the Social Security tax self-employment income ceiling is $106,800 (same as the wage ceiling for employees). So if your 2010 self-employment income was $106,800 or more, you paid the Social Security tax maximum of $13,243 last year (12.4% x $106,800 = $13,243).

In 2011, the hit will be less thanks to a one-year 2 percentage-point reduction in the Social Security tax rate on self-employment income -- from the normal 12.4% to 10.4%. For 2012 and beyond, however, the Social Security tax on self-employment income is scheduled to return to the standard 12.4% rate.

To give you an idea of how the Social Security tax can add up over your working life, consider my personal situation. In 35 years behind the grindstone (about half as an employee and the other half self-employed), I've paid $219,000 in Social Security tax. My employers paid another $41,000. That amounts to $260,000 in total. During my time as a self-employed guy, I've had some years where my Social Tax bill exceeded my combined federal and state income tax bills.

Believe me, if I could get the $260,000 back, stop paying the tax, and forego receiving any benefits, I would do it in a heartbeat. In fact, if I could just stop paying the tax in exchange for walking away from any future benefits, I would do that too. Why? Because I have big doubts I will actually receive the promised level of benefits when the time comes.

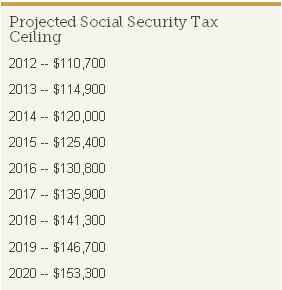

And thanks to the government's official contention that there has been little to no inflation over the past few years, the Social Security tax ceiling has been stuck at $106,800 since 2009. However, the latest Social Security Administration projection says it will start rising again in 2012 and beyond. The projected ceilings for the next nine years are as follows.

If these numbers pan out, the maximum Social Security tax hit in 2020 would be $19,009 (12.4% x $153,300). That's assuming Congress doesn't increase the tax rate, which could easily happen. There's also a chance the ceiling will be increased beyond what you see here or even entirely removed in an attempt to put the system on a sounder financial footing. If there's no ceiling, you would owe Social Security tax on wages and self-employment income on every dollar you earn.

Another misunderstanding about Social Security: Some people think the government has set up an account with their name on it to hold the money to pay for their future Social Security benefits. After all, that must be where all the Social Security taxes on people's wages and self-employment income go, right? Wrong. There are no individual accounts. In fact, when the Social Security system runs a surplus (which it has in most years until now), the federal government sucks out the excess cash and issues the system an IOU. But the only way those IOUs will ever be paid is through future taxes. Meanwhile, the system is now projected to run out of money (including those nebulous IOUs) in 2036 unless taxes are raised or benefits are cut.